My primary guiding principle for the balance of this year is ... no apparent headwinds.

Sustaining Stats

There have been no appreciable changes to key economic indicators since our July newsletter article. That said, here are some updates and perspectives to add to our (yours and my) decision-making matrix.

Then we’ll take a look at possible scenarios following November’s national elections … and ask you to sound off (anonymously of course) on potential net effects for us as residential real estate investors and landlords.

Federal Rate Cuts: Federal Reserve Chair Jerome Powell strongly hinted that a cut is coming during his Jackson Hole economic symposium speech. On August 23 he said, “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” Of course rate reductions will be welcomed … the first anticipated on September 18.

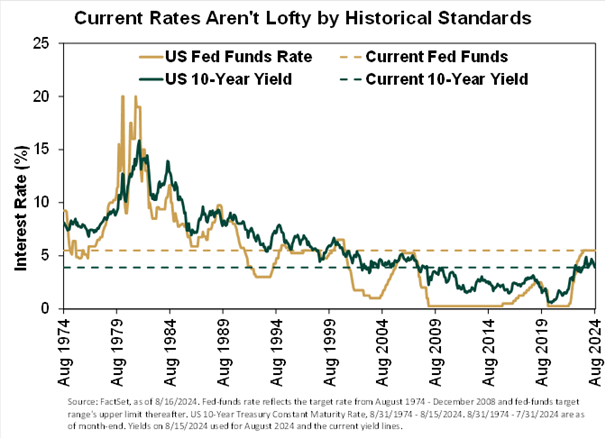

Note: There is some controversy among economists whether the Fed’s idea of “sustainable interest rates” in the 2s is feasible. As ever, we’ll remain alert to actions proposed or initiated by the Fed.

It’s worth an historical perspective to avoid a “myopic moment”. In fact, today’s fed-funds rate and 10-year Treasury yield are historically quite normal long-term.

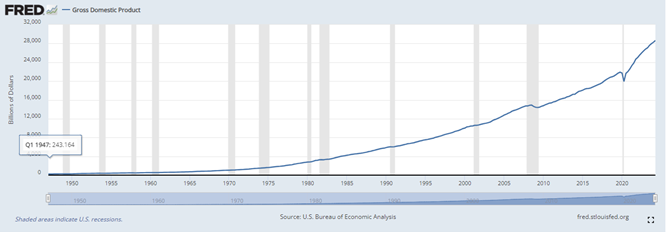

Strong GDP: Here’s a picture that says it all. Click here to access the interactive graph.

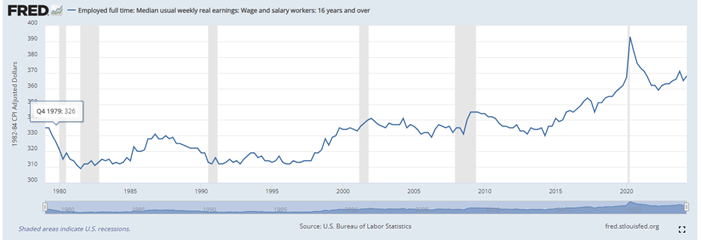

Wage Inflation: As we’ve discussed and disputed in past articles, the Fed folks deem wage growth inflationary. Not so! Five decades ago, Nobel Prize winner Milton Friedman proved that rising wages always follow inflation … they never cause it. Case in point, average weekly wages has been largely outpaced by a 20% price increase across the board since January 20, 2021, according to data from the Bureau of Labor Statistics. Click here for the interactive version of the graph below.

Note: While inflation has dropped precipitously, wages have actually eased more slowly. Most recently, inflation and wage growth were at 2.9% and 3.9%, respectively. To say it again: Inflation first; wage hikes later.

So, in addition to the above, residential rental investors are enjoying:

- Reduced cost of borrowing;

- Inflation down;

- Monetary policy easing;

- Unemployment rate at historical lows;

- Prices likely to ease in next few months;

- Economic equilibrium with no surprises on the horizon.

Let’s all remain diligent to see how the foregoing delivers positive investment outcomes on residential rental properties from wage inflation, leverage, maintenance costs, motivations to buy/sell, cash flow and property valuations.

November Presidential Elections

Whether our president elect is Trump or Harris, the winner will have their work cut out for them in dealing with existing budget deficits, green economy efforts, data centers enhancements and geopolitical challenges. Not the least pressing is the potential for inflation volatility driven by demand-boosting policies … read tax cuts … or supply-hurting policies such as price controls and tariff hikes.

Now coming off the effects of crippling inflation, let’s take a look at what we know from campaign speeches by each of the candidates on that topic.

BTW, this is a reader-participation event. I’ll provide stated economic positions of Trump and Harris. Then will love to hear from you regarding your assessment on potential for inflation-redux as a consequence.

Trump

He prompts concerns that a second term would mean higher tariffs and increased federal deficits. For example:

- Tariff increases of 10-20% on all imports.

- 60 percent tax on Chinese goods.

- Targeted tax cuts, including eliminating federal income taxes.

- Pay for tax cuts with increased tariffs.

- Ramp up U.S. manufacturing and reduce foreign manufacturing relationships.

Harris

Her proposed measures are embodied in her “Opportunity Economy” program. Here’s an outline.

- Attack corporations for “price gouging” on food, groceries and medications, i.e. price controls.

- Raise corporate tax rate to 28 percent from current 21 percent.

- Restore and increase the Child Tax Credit.

- Down payment subsidies for first-time home buyers.

- Silent on the unsustainable trajectory of federal debt and effect of her proposals.

Takeaways

Together, you and I are in the business of wealth creation via investments in residential rental properties. That means taking an intelligent, calculated approach to evaluating and executing decisions based on a variety of critical factors. At least for the balance of this year the economic outlook appears to be comfortably predictable. Post-election will bring new essentials to our decision-making matrix.

Note: Whether becoming a landlord was a choice or a result of circumstance, it doesn’t change the fact that managing any property comes with its challenges… and we want to help.

Give us a call or drop an email. We’ll respond promptly to relieve

your stress and help you evaluate your property management options

plus maximize your rental property return on investment.