Getting Ready to Get Ready for 2024!

(First in a Series of 2 Articles)

In planning for the upcoming year, I rely on my interpretation of the importance of 5 Indicators.

Fed Actions

Rent Growth

Wage Inflation

Employment Statistics

New Residential Rentals

Please review this issue for the first 3 Indicators listed above as a potential guide for your planning in 2024. Next issue, we’ll cover 4 and 5 above. The significance is in the trends … always with the caution that past performance is no guarantee of future results.

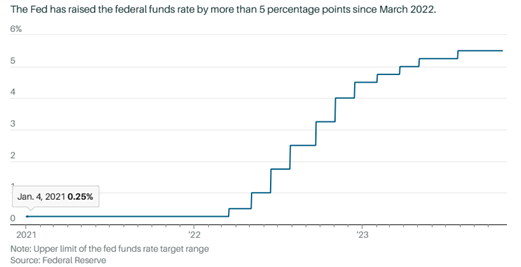

Fed Actions

It was widely anticipated that another Fed pause in rates was in the cards. That expectation was confirmed by Federal Reserve Chair Jerome Powell in his press conference on Wednesday, November 1, 2023. His message pauses the upward spiral in the federal funds rate over the last one and a half years now held at a 22 year high.

Here are five key takeaways from Wednesday’s Federal Open Market Committee rate decision and Federal Chair Powell’s press conference:

The FOMC statement was essentially unchanged. Fed officials held their benchmark interest rate steady in a range of 5.25% to 5.5% while leaving the door open for more hikes.

Another pause on rate hikes does not mean it will be difficult to raise again, says Powell. He added that the central bank hasn’t made any decision for its December meeting and “The Committee will always do what it thinks is appropriate at the time.”

While Powell didn’t specify that future rate hikes were off the table, he said there’s a long way to go to get inflation back down to the Fed’s target of 2%. Slower growth and a softer labor market are still likely to tame inflation and restore price stability.

Powell stressed that the central bank hasn’t begun considering a rate cut, and it won’t until inflation is brought under control.

Powell said the strength of consumer and small business’s finances may have been “underestimated” as spending remains strong.

Given the above summary, I tend to concur with a growing consensus that the Fed will likely keep its policy unchanged into 2024. Long-term interest rates have risen in recent months even though the Fed’s hikes have been on pause, which may make the Fed more comfortable holding the benchmark rate at its current level.

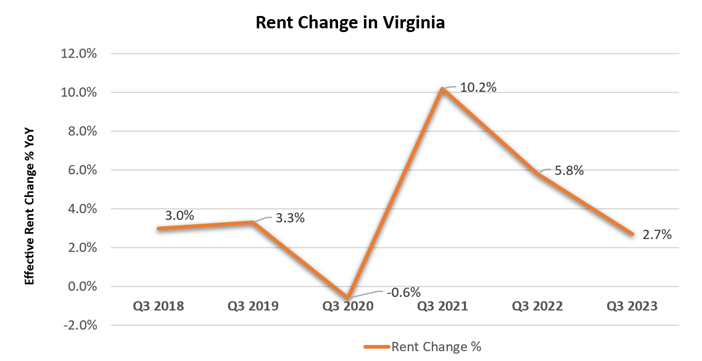

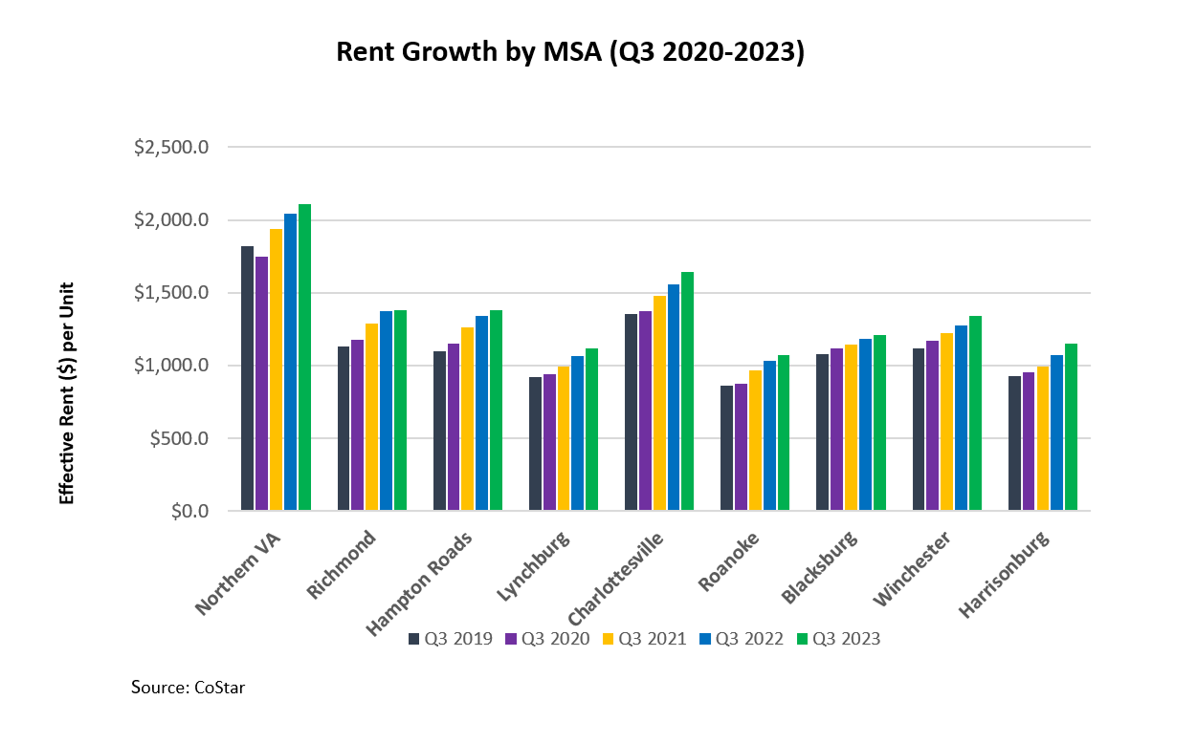

Rent Growth

Virginia’s housing market has been impacted by interest rates North of 7% and housing prices above $400,000. These factors have shifted the sights of many potential home buyers to the rental market. Pent-up demand has triggered multi-family rents to go up more than 17% nationally. Rents in Virginia followed a similar pattern.

Statewide, rent growth has started to decrease with rents up 2.7% from a year ago. The slowdown in rent growth is a positive sign for renters that the multifamily market is beginning to stabilize.

It is important to remember that rents are still 19% higher than they were four years ago. The multifamily market will be important to watch as mortgage rates continue to cause affordability challenges for would-be home buyers and the supply of new apartments begins to moderate.

And notably, tenants are paying their rent. RealPage reports that market-rate rent collections climbed to a 3-year high of 96.03% … highest since March 2020 … further evidence that renters are generally in stronger financial shape than often reported by pundits. That finding is consistent with a Bank of America report that consumers were in solid financial shape due to wage gains … of particular importance as C-19 government subsidies are now a thing of the past yet rent collection stability remains robust.

The Case for Wage Inflation plus Value-Adds for Landlords

So, Virginia employers and jobseekers are increasingly satisfying their mutual employment objectives. I believe that the trend in higher employment and increased wages will continue at least through 2024. Additionally, wage inflation is in lockstep with higher employment as employers continue to bid for quality workers.

According to the Harvard Business Review, the sources of strength in the U.S. economy is, “The booming labor market translates into wages and spending, which is a good place to start gauging the strength of the real economy”.

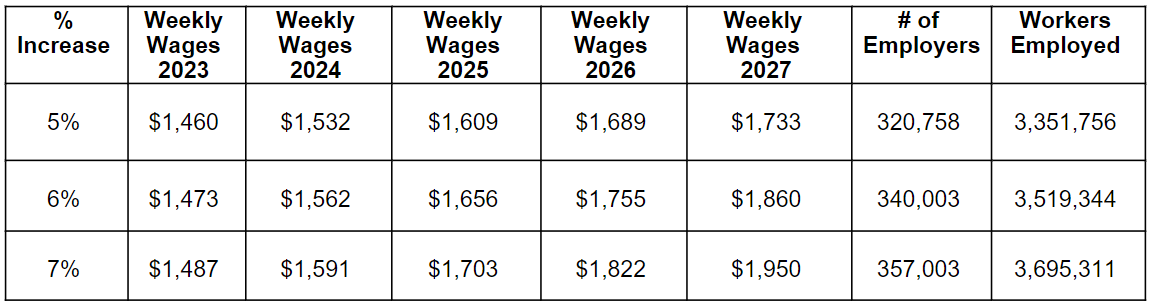

Consider this. The BLS reports the end-of-year 2022 increase in weekly wages at 8.9%. If wage inflation and employment growth continue, even at conservative annual growth rates, weekly paychecks and employment statistics may look like the following over the next 5 years.

Admittedly, there are “wild card” factors that may affect the economy in upcoming months … the 2024 elections; Fed moves; geopolitical developments, recession pressures, etc. That said, I’m of the opinion that wage inflation, job growth and single-family home prices will continue to expand this year and into the next.

So, how is wage inflation, rising employment and home purchases beyond the reach of potential buyers likely to affect residential landlords like you and me? I’m convinced there will be robust gains in employment, wages and spending power in 2024. The net effect for residential rental investors will be an expanded tenant pool of workers enjoying sizable bumps in income. In turn we will enjoy enhancements in rental income, tenant quality and appreciation in asset values.

Look for the Second Article in this series and review the latest developments in Employment Statistics and New Residential Rentals.