It’s “early days” in the new year. That said, I’m approaching 2024 with optimism cloaked in alertness to events that affect residential rental landlords ... and of course our company as property managers.

So, in this issue we’ll review our past positions on Inflation Drivers, Employment Trends and Interest Rates with appropriate assessments of past performance and likely future developments.

Inflation and Its Drivers

Inflation ticked up a bit in the last month of 2023 as indicated in a consumer price index (CPI) bump from 3.1% to 3.4%. Not cause for major concern as economic data and markets never move in linear fashion. Certainly, I don’t read it as precursor to a renewed inflationary trend.

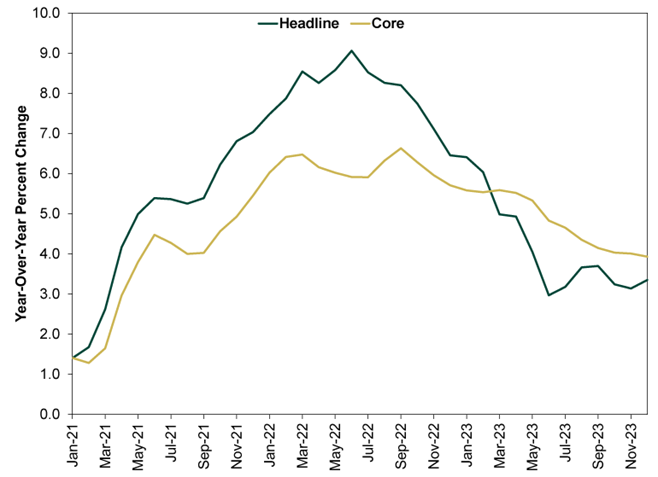

In context, recall our recovery from near double-digit inflation in 2022 to December’s 3.4%. Exhibit 1 below shows the year-over-year changes in both headline and core CPI since January 2021. Notably, headline CPI has returned to its historical pre-pandemic average, with core inflation improvement as well.

Exhibit 1: Inflation’s Arc

Source: FactSet, as of 1/11/2024.

Note for residential landlords: Core CPI excludes the volatile prices of food and energy data as well as owners’ equivalent rent (OER). OER is the amount of monthly rent that would be equivalent to the monthly expenses of owning a property (e.g., mortgage, taxes, etc.). Excluding shelter, services inflation is down from 8.2% in September 2022 to 3.4% in December 2023.

OER to many is a questionable input. That said, it tends to lag real-world home prices by a year and a half. So, with mortgage rates expected to ease and supply coming back on the market, rents too should improve.

Inflation Drivers – 2 Myths:

Often “conventional wisdom” economics thinkers blame inflation on rising prices. Well consider this in light of our significantly diminished rate of inflation.

Myth #1:

In Q4 2023, consumer price inflation rose 3.4%, while producer price inflation increased by1%. That means businesses raised prices 3 times higher than their increase in costs. Net effect on inflation ... certainly not an increase! Lesson ... rising prices do not cause inflation.

I made the comment in a newsletter last year that, “To say rising prices cause inflation is akin to saying snow drifts cause blizzards.” Recently a noted economics pundit mirrored that sentiment with, “... rising prices do not cause inflation. To say they do is like saying that stomach aches cause chocolate.”

Myth #2:

Another supposed inflationary culprit is embraced by Fed economists and advisors who cling to the notion that higher inflation is linked to lower unemployment and vice versa … despite clear historical evidence that theory is neither sound nor valid. Their assertion is based on a 65-year-old theory called the Phillips curve which drives their conclusion ... An important way to fight inflation is to weaken the labor market.

An economic model is ultimately good only if you realize reliable explanations and forecasts over time. History negates the Fed’s position on the relationship between inflation and unemployment. In fact, increased wages and employment gains are not drivers of inflation. Inflation drives rising pay … not the reverse.

Wage inflation drives growth as more workers are employed and produce goods and services that generate profits in excess of employee compensation.

In a recent Washington Examiner article, my conviction regarding the Phillips curve is echoed, “The Phillips curve positing a trade-off between unemployment and inflation is a false dichotomy …”

Employment Trends

While white collar, high-income office workers face escalating job losses … those in blue-collar and the trades sectors are likely to fare much better. Increasingly, more people are choosing the skilled trades and avoid crippling student college debt to finance their career training. These career trends present an evolving, growing pool of well-paid tenants!

Notably, there’s considerable upside potential for job growth as the Virginia Worker Shortage Index gap shrinks. Refreshingly, the U.S. Chamber of Commerce reports this month there are 47 available workers for every 100 job openings ... down from a high of 54 last year.

Interest Rates

It’s anybody’s guess where the economy, including interest rates, may evolve in an election year. Here are three prevailing projections.

The Federal Reserve will likely lower its benchmark interest rate in March and make 5 cuts in 2024.

The median projection from all Fed officials is three rate cuts in 2024.

Mortgage rates should go down in 2024, with some forecasts predicting they'll drop close to 6% by the end of the year.

My take ... let’s sit tight through Q1 before deciding on planning alternatives.

Takeaways

Admittedly, there are “wild card” factors that may affect the economy in upcoming months … the 2024 elections; Fed moves; geopolitical developments, artificial intelligence to name several major items. That said, I’m of the opinion that wage inflation, job growth and increased spending power will continue this year and into the next.

That means residential landlords like you and me are likely to experience an expanded tenant pool of workers enjoying sizable bumps in income. Results: Enhancements in rental income, tenant quality and appreciation in asset values.

Whether you are a DIY landlord or someone that needs property management services … or a combo of the two, KRS Holdings is here to help!

Give us a call or drop an email. We’ll respond promptly and

relieve your stress by evaluating your property management options.