Click here for a first-time or refresher read of the first article.

The pundit economists, through professional perception or projection, have heralded the imminent recession…or suggests that we’re in the middle of one right now. I’m not an economist so will not try to defend or deny any of these opinions. What I will do in this piece is offer real-life perspective based on my experiences as a successful residential real estate investor and property manager…and the reported observations of my many customers and investors.

Bottom Line: The Sky is Not Falling…6 Tangible Proofs – the final 3!

People are paying their bills…including tenants

Unemployment at or near historical lows

The Phillips Curve – Foundation for Fed's Faulty Figurin'

Wage Inflation to Continue

Inflation Rate Significantly Down

Rents On the Upswing

Wage Inflation to Continue

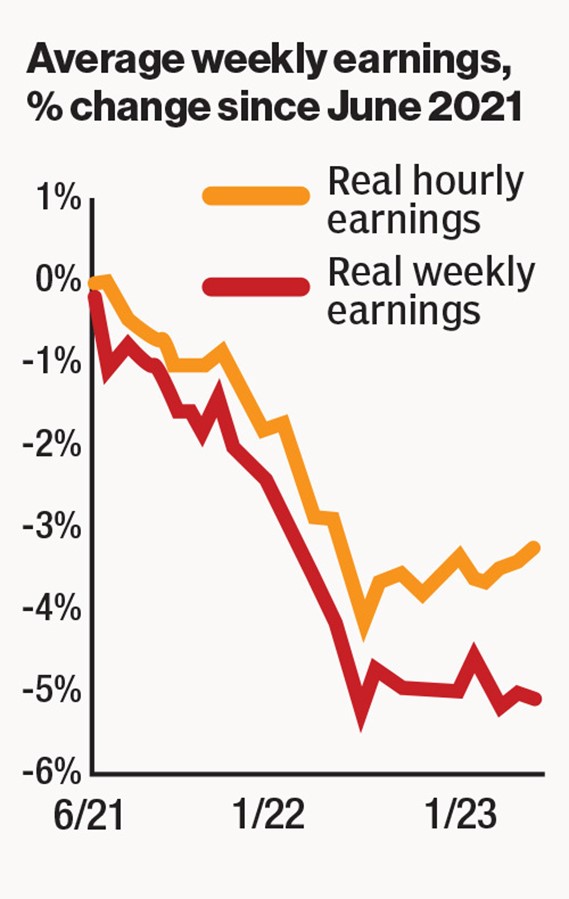

I believe wage inflation will continue at least through 2024…for three primary reasons.

Employers will continue to compete and increase compensation bidding to attract/retain quality workers in this low unemployment environment.

American workers are not stupid! In 20 of the last 22 months, both real hourly earnings and real weekly earnings have fallen below inflation…wages up roughly 12%, inflation up 15%.

The labor force will continue to lobby employers for increased compensation to close the gap.

Increasingly, employers are reversing the work-from-home status of workers. That has prompted backlash from white collar employees unwilling to return to the office…without financial incentives to do so.

A July nationwide survey conducted by online marketing and content website Authority Hacker asked 3,000 full-time employees who work from home what cash lump-sum payment would persuade them to return to full-time office work.

Virginia survey-takers on average asked for $12,438, close to the national average of $12,188.

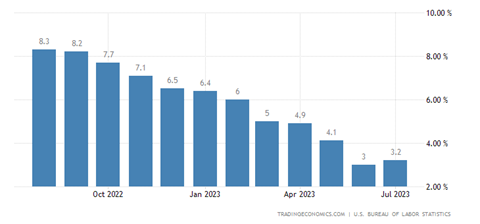

Inflation Rate Significantly Down

Inflation has decreased to 3.2% in July 2023 from its peak of 9.1% a year earlier. As inflation is further reduced, that may motivate reduced federal borrowing and spending in favor of refinancing current national debt at more favorable rates and reduce the deficit.

Good for landlords, consumers & economy.

Rent Increases Keep Pace with Inflation

KRS Holdings manages multi-family as well as single-family homes. Here’s a brief history of rents for a representative sampling of working-class/blue-collar residences that we serve. All are 3-bedroom, 1-bath units.

Apartments

Monthly Rent in 2020…$840;

Monthly Rent in 2023…$1,245

Monthly Increase…$405 = 48% boost to revenue

Single Family

Monthly Rent in 2021…$725

Monthly Rent in 2023…$1,195

Monthly Increase…$470 = 65% boost to revenue.

Takeaways

Now in our post-pandemic economy…even in the face of real or imagined recession pressures...there will be robust gains in employment, wages and spending power. The net effect for residential rental investors will be an expanded tenant pool of workers enjoying sizable bumps in income.

Residential landlords take note…we have a near-term opportunity to:

- increase rents

- make needed property improvements, and

- appeal to tenants who can afford to upgrade their housing

Whether you are a DIY landlord or someone that needs property management services … or a combo of the two, KRS Holdings is here to help!

Give us a call or drop an email. We’ll respond promptly and relieve your stress by evaluating your property management options.