In this issue, I’ll take a tack on a topic other than inflation … recession!

It’s been going on for months … pundit economists predicting the likelihood of an imminent recession in the U.S. Admittedly, I’m not an economist, but as a successful residential real estate and property manager I do have certain economic “compass coordinates” that influence my decision making.

Here is my thinking regarding key factors that indicate or negate the potential for a looming recession. I’ll make it short.

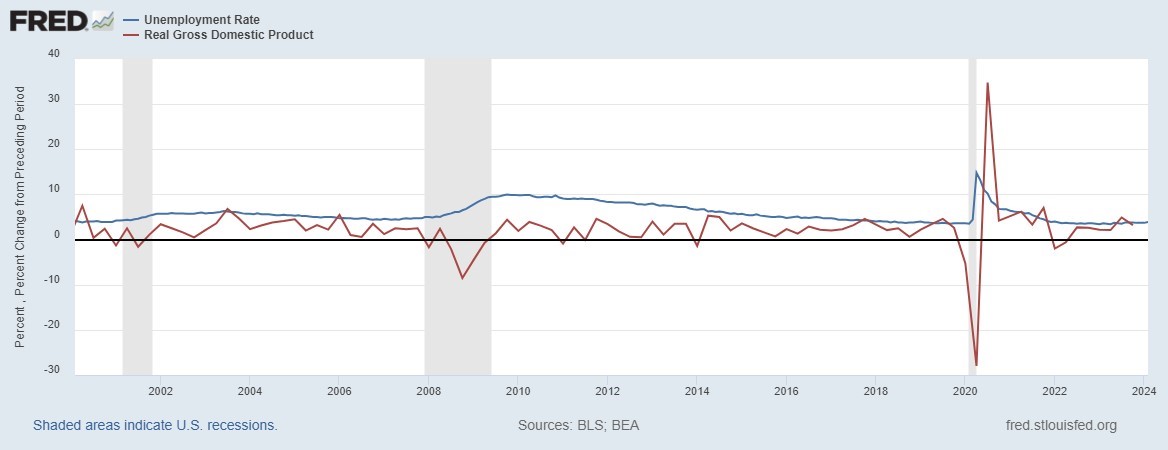

Gross Domestic Product (GDP) & Employment … The Relationship

First, a distinction between the two.

- GDP measures total economic performance.

- Employment is but one factor of the U.S. economy and alone does not drive GDP.

- Employment levels and GDP are historically linked and proven by “Okun’s law”.

- Okun’s law says a 1% fall in the unemployment rate yields a 3-4% rise in GDP.

- Conversely, GDP must grow at about a 4% rate for one year to achieve a 1% reduction in the rate of unemployment.

The logic behind Okun’s law is simple. Output depends on the amount of labor used in the production process, so there is a positive relationship between output and employment. Click here for an interactive version of the graph below that illustrates this point. You’ll see the following low unemployment rates for the last 3 months:

- December 2023 – 3.7%

- January 2024 – 3.7%

- February 2024 – 3.9%

So, if employment remains constant or on the upswing you must conclude that GDP will continue to surge. And that is the opposite of a recession defined as … a period of temporary economic activity generally identified by a fall in GDP in two successive quarters.

Other Factors to Consider

Of course, the GDP/Employment relationship is but one factor to consider in contemplating the potential for recession. A few months ago, I offered 6 tangible proofs that “the sky is not falling” based on my real-life perspective as a successful residential real estate investor and property manager … and the reported observations of my many customers and investors.

- People are paying their bills … including tenants

- Unemployment at or near historical lows

- The Phillips Curve – Foundation for Fed's Faulty Figurin'

- Wage Inflation to Continue

- Inflation Rate Significantly Down

- Rents On the Upswing

Not much has changed since then. I invite you to revisit or read for the first time the following articles.

WHAT IF THERE WAS A RECESSION … AND NO LANDLORDS OR TENANTS CAME?

KRS HOLDINGS - TUESDAY, AUGUST 29, 2023

WHAT IF THERE WAS A RECESSION … AND NO LANDLORDS OR TENANTS CAME? (Second in a Series of Two)

KRS HOLDINGS - WEDNESDAY, SEPTEMBER 13, 2023

Takeaways

- GDP and employment track together.

- If there is no significant job loss that factor does not point to a slowdown in GDP.

- Employment is one of several indicators of potential recession on the horizon.

Whether you are a DIY landlord or someone that needs property management services … or a combo of the two, KRS Holdings is here to help!

Give us a call or drop an email. We’ll respond promptly and

relieve your stress by evaluating your property management options.