PERCEPTION IS REALITY ... THE WAY WE BELIEVE THE WORLD TO BE

- Inflation Stabilized

- Inflation + Interest Rates … Leverage, Synergy, Profits

- What Does Inflation at 2% Mean?

Myopia: When close-up objects look clear but distant objects are blurry.

When it comes to investing, perception has a profound impact on our decision-making. Faulty perception leads to actions misaligned with reality. So, in this second article in the series I offer an extended view of the U.S. economy as it relates to all of us as residential real estate investors. Objective: Avoid fuzzy vision of current economic triggers.

In last month’s issue, we reported on a recap of Q1 2024 as presented by the U.S. Department of Commerce in the article entitled ... By the Numbers: Continuing to Outpace Expectations ... U.S. Economy Gains. And I cautioned that focusing on only some performance stats can foster investor myopia. Specifically two ‘I’ words … interest and inflation … are not the only drivers of intelligent planning. As promised, in this piece we deal with the relationship of the two.

A Word About the ‘I’ Words

No single economic factor is the sole driver of residential real estate success. And yet too often either inflation or interest rates dominate decision-making by landlords and investors. Now, I’m going to make a case that inflation is the friend of residential rental investors. We’ll assume SFH rentals for simplicity.

The borrower’s nominal interest rate charged by the lender minus the rate of inflation = real interest rate ... the true cost of borrowing. So, today’s 30-year fixed rate loan of about 7% minus the current rate of inflation of 3.5% means the borrower’s out-of-pocket interest cost is 3.5%.

Stay with me! In a moment, we’ll illustrate how the true cost of borrowing is critical for evaluating a deal. The point is ... don’t delay investment decision-making in hopes that interest rates tumble to 2022 levels and inflation falls to the Fed’s target of 2% to bail you out.

Embrace a long-term strategy and reap the increasing rewards over time.

Residential Real Estate Wealth Creation ... An Example

30 Year Fixed Rate Mortgage

Purchase Price | $250,000 | Inflation Rate | 3.5% |

Interest Rate | 7.0% | Effective Interest Rate | 3.5% |

Amount Financed | $200,000 | Effective Interest Rate | 3.5% |

Monthly Payment | $1,331 | Effective Monthly Payment | $898 |

Effective Monthly Payment Savings | $433 |

The table below includes the following projections:

- Asset value of the property will increase generally in synch with inflation

- Landlords enjoy inflation-stimulated rental spread increases while loan servicing remains level.

Assumptions:

Monthly Rent $2,500; Inflation Increase 3%; Annual Rent Increase 3%; Monthly Expenses: $400

Year 2 | Year 5 | Year 10 | |

Rent + 3% | $2,575 | $2,814 | $3,262 |

Expenses (taxes/ins./maint.) | $412 | $464 | $522 |

Monthly Mortgage Payment | $1,331 | $1,331 | $1,331 |

Estimate Net Monthly Cash Flow | $832 | $1,019 | $1,409 |

Annual Net Cash Flow | $9,989 | $12,233 | $16,913 |

Accumulated Principal Paydown | $4,210 | $11,779 | $28,378 |

Total Cash Plus Existing Equity | $66,113 | $76,075 | $97,270 |

Asset Appreciation @ 3% Ann. | $7,500 | $48,513 | $96,058 |

Wealth Created | $77,823 | $136,367 | $221,706 |

Takeaways

As I see it, the primary guiding principle for the balance of this year is ... there are no apparent headwinds.

- In a speech on May 14, Fed Chair Powell told the Foreign Bankers' Association in Amsterdam that the U.S. economy "has been performing very well lately." He added that consumer spending and business investment have been strong. Powell also said inflation showed "progress," … and deemed a rate hike unlikely, and a hold on rates a strong possibility.

- According to Zillow, national rent increases came in at 3.4% … outpaced by wage growth of 4.3%. Combined, it supports grounds for investors to increase rents.

As fellow investors/risk-takers, we abhor uncertainty. At least for the balance of this year all seems to be comfortably predictable.

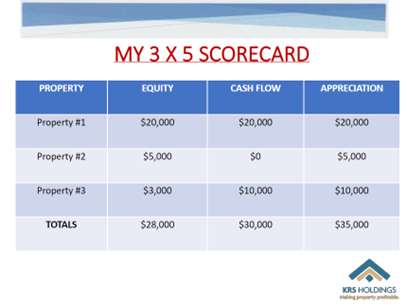

So, it all boils down to “does the deal make sense?”. Here’s a tool I find valuable as a portfolio snapshot. You may find it useful in valuing your holdings as well.

Note: Whether becoming a landlord was a choice or a result of circumstance, it doesn’t change the fact that managing any property comes with its challenges… and we want to help.

Give us a call or drop an email. We’ll respond promptly to relieve

your stress and help you evaluate your property management options

plus maximize your rental property return on investment.