.png)

INFLATION, THE FED & THE INFLATION REDUCTION ACT

What SFR & MFR Landlords May Expect

Inflation & The Fed

By now, you’d need to have been in isolation to not know that inflation in August exceeded all expert expectations … a whopping 8.3% jump! The higher-than-anticipated number was driven by increasingly high prices for daily necessities such as food and rent. Additionally, the cost of many consumer goods remains uncomfortably high for cash-strapped Americans.

The net effect has been the Fed’s response consistent with its plan to continue rate hikes until inflation shows meaningful signs to recede to the 2% range. That response was a 75-basis point bump in its benchmark rate for the third consecutive time.

As a peek at future Fed actions, Fed Chair Jerome Powell made it clear that the Fed was wary of “prematurely loosening policy” and was “strongly committed to this project and we will keep at it until the job is done.” Mirroring that commitment, Fed Vice Chair Lael Brainard said the bank was “in this for as long as it takes to get inflation down.”

Best guess is another 1¼ point jump by year-end.

Residential Rental Investors

Generally, inflation positively impacts rent increases for residential landlords to keep pace with the rising price of goods. Inflation also benefits residential rental investors in “supply and demand” … as construction costs surge fewer new rental properties are available.

An added plus is inflation increases the cost of housing … which means fewer people can afford to buy a home, thereby increasing the demand for rental housing. With increased demand and little supply, property owners are more likely to get the rental rates they’re asking … even if they’re a little high. Everyone needs a roof over their head, and renting housing is generally more affordable than purchasing a home.

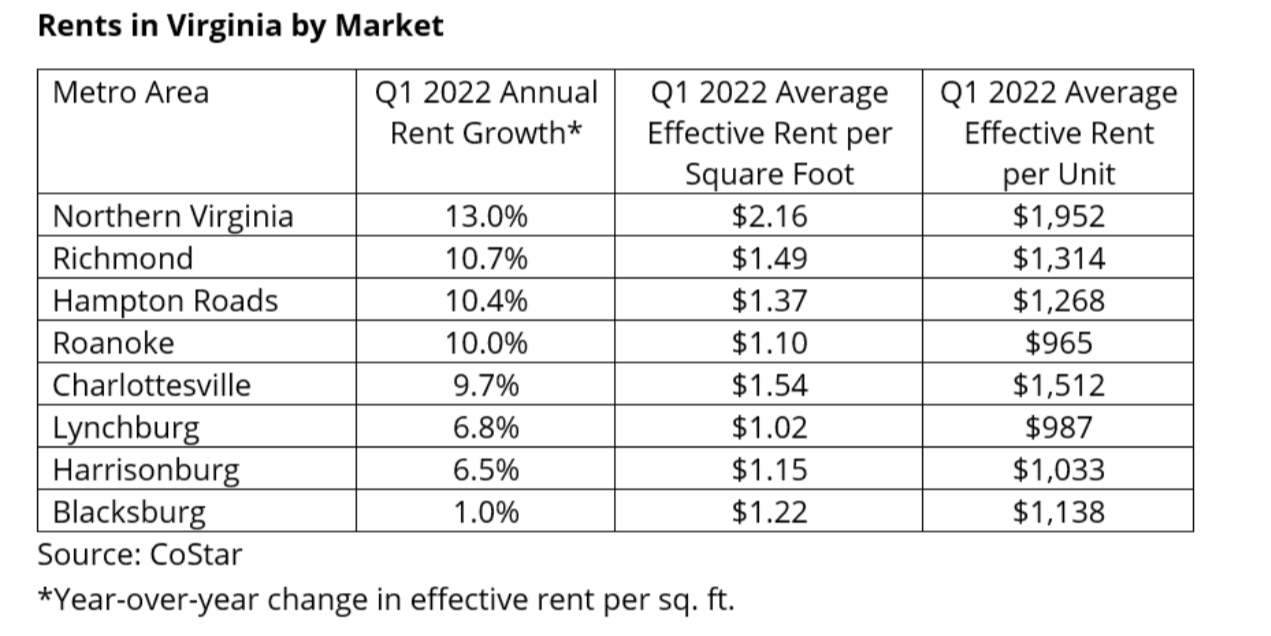

According to Virginia Realtors, here’s what the rent landscape looks like in the Old Dominion this year.

Of course, inflation isn’t all positive for landlords … as your rental income goes up, so do your expenses. As the costs of goods and services increase, your rent hikes will be offset by the rising costs of managing and maintaining your rental properties. Here’s a sampling of rental property expenses that have increased during this high inflation period:

Maintenance expenses (lawn care, painting, etc.)

Major renovations (roof replacement, new water heater, etc.)

Mortgage rates (driven by Fed interest rate hikes)

Property taxes (driven by higher property market values)

Marketing costs to find tenants (Broker fees)

Interest rates on non-confirming loans (Private and Hard money lenders have also increased interest rates)

Landlord insurance premiums

You may be wondering by how much? Here are some indicators of consumer prices between June 2021 and June 2022:

The cost of energy, household furnishing and supplies and services (among other things) have increased 41.6%, 10.2%, and 5.5% (less energy services) respectively.

The cost of Building Material and Supplies Dealers increased from 153.50 in January 2020 to 233.562 in June 2022, an increase of 52%.

The Inflation Reduction Act

The Inflation Reduction Act was signed into law on August 16. The bill includes several relevant provisions for residential rental investors including:

No change in the taxation of carried interest;

Energy efficiency tax incentives; and

Grants to accelerate state adoptions of stricter building codes.

The following is a summary of my understanding, as a residential rental property investor, of some provisions of the legislation as it may apply to SFR and MFR landlords. It is not intended as or to be construed as advice. You are encouraged to seek assistance from your tax advisor to determine how the Act may affect your unique circumstances.

Summary

SFR & MFR Related | Summary Provisions |

Carried Interest | The final bill did not change the taxation of carried interest. As originally proposed it would have negatively impacted multifamily investors by requiring that an asset be held for 3 years before it qualified for carried interest treatment. |

Energy Efficient Commercial Buildings Deduction

| For property placed in service in 2023, the base credit for qualifying buildings is increased. Additionally, deductions for energy efficient lighting, HVAC and building envelope costs placed in service as part of a retrofit are permitted. |

Extends Limitation on Excess Business Losses of Non-corporate Taxpayers | The Act includes an extension of the limitation rules for deducting excess business losses for non-corporate taxpayers through 2029. Excess business losses are the amount in which business deductions exceed gross business income. |

New Energy Efficient Home Credit

| The New Energy Efficient Home Credit extended through 2032 for current qualifying buildings. After 2022 would apply to all buildings meeting the requirements of the ENERGY STAR Multifamily New Construction Program. |

Building Codes

| The package allocates $330 million in grants to help states adopt the most recent residential and commercial building energy codes International Energy Conservation Code ASHRAE Standard 90.1-2019 or codes achieving equal or greater energy savings. In addition, it provides state and local governments $670 million to adopt building codes that meet or exceed the zero-energy provisions in the 2021 IECC. |

Affordable Housing

| The package includes $837.5 million for HUD to provide grants or loans to affordable housing owners that implement: Energy or water efficiency; Indoor air quality or sustainability; Zero-emission electricity generation or low-emission building materials or processes; Energy storage; Building electrification; and Climate resilience. |

New Energy Efficiency Rebates

| The IRA includes funding for states to create programs to offer Homeowner Managing Energy Savings (HOMES) Rebates. A portion of these funds will be available for owners of multifamily properties to retrofit their units or buildings. The Act also includes $4.275 billion for states to implement a high-efficiency electric home rebate program that can be used by single-family and multifamily property owners to upgrade inefficient and non-electric water heaters, HVAC systems, appliances and clothes dryers, as well as for insulation, air sealing and installing electric load or service center panels. |

Click Here for a more detailed view of the Act and its effect on SFR & MFR investors.

Whether you are a DIY landlord or someone that needs property management services … or a combo of the two, KRS Holdings is here to help!

Give us a call or drop an email. We’ll respond promptly and

relieve your stress by evaluating your property management options.