AFFORDABILITY … the current buzzword of politicians, pundits and publishers!

In this issue, we’ll address affordability from the perspectives of both landlords and renters … clearly a complementary “team” as it relates to vacancy rates, rents and satisfaction of mutual housing needs as we enter the New Year. The by-product for both parties … predictability.

Quick Recap: Be sure to read or re-read our two previous articles … the first that deals with Renters and Rents; the second with an eye to residential rental market Predictability and long-term Bonus. Doing so will provide a foundation for our 3-part discussion on this issue:

Caution in Rent Increase Expectations

Fed Rate Reductions … Effect on Renters/Homebuyers

Relationship of rent price increases, home prices … vs. household income. A case for renting.

Rent Increase Expectations

Virginia’s unemployment rate has steadily creeped up from 3.6% in August of this year and is expected to increase to 4.1% by year-end. The Weldon Cooper Center cites economic policy and employment ties to the federal government as the driving factors.

That means that wage inflation may have peaked. For investors considering a rental purchase, it’s important to buy with caution as rent increases may not be available to buy you out of a bad deal.

Additionally, we’re seeing evidence of multi-family rent concessions/reductions on the upswing.

Fed Rate Reductions … If Any, Effect on Renters/Homebuyers

The question remains … will the Fed cut its rate and if so, what affect will that have on 30-year fixed mortgage rates? Clearly, a Fed rate cut does not have an immediate impact on reducing mortgage rates. However, such cuts have an influence by affecting the 10-year Treasury yield which is a key benchmark for mortgages.

Historically, a 100-basis point (1%) Fed rate cut has correlated with an 87-basis point (0.87%) reduction in mortgage rates. So, let’s look at what scenario might drive mortgage rates down to the point of significant motivation to drive homebuying. We’ll start with a current assumed 30-year fixed rate of 6%.

Fed Rate Cut | Mortgage Rate Cut | Mortgage Rate |

0 | 0 | 6% |

25 bps | 21.75 bps | 5.78% |

50 bps | 43.5 bps | 5.57% |

100 bps | 87 bps | 5.13% |

200 bps | 174 bps | 4.26% |

Many forecasts from major organizations predict rates will stay above 6% throughout 2025 and likely to have minimum impact near-term 2026. That’s my take too.

Landlords: Rank predictability that mortgage rates will remain high and not impact

increased home buying in 2026 … on a scale of 1 -5 (highest).

A Case for Renting vs. Home Ownership

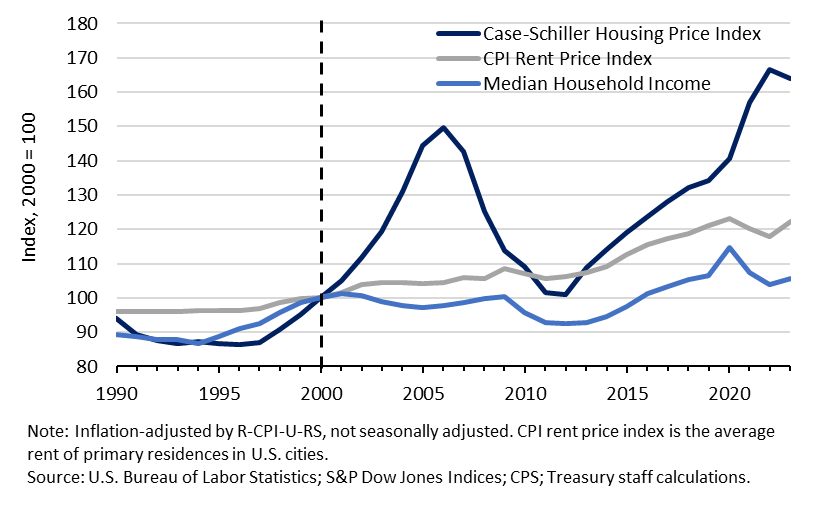

Rent prices have risen faster than household income … but far below the rate of home ownership.

Landlords: Rank predictability to rent rather than buy in 2026 … on a scale of 1 – 5 (highest).

2026 = 2025 Redux!?

For you and me, as present or planned residential real estate investors, the foregoing stats point to a marketing strategy that triggers attraction and retention of quality tenants. All of us, and renters too, make buying decisions based on 4 considerations. Will it:

Make Money

Save Money

Save Time

Peace of Mind

Landlords: Plan how you will position your property offerings to enjoy each of the above

while delivering affordability to attract and retain quality renters.

Whether becoming a landlord was a choice or a result of circumstance, it doesn’t change the fact that managing any property comes with its challenges… and we want to help.

Give us a call or drop an email. We’ll respond promptly to relieve

your stress and help you evaluate your property management options

plus maximize your rental property return on investment.