WHEN INFLATION IS YOUR FRIEND!

SFH Landlords & Wannabes

Bulletin! How Borrowing Converts Cost to Profit

Traditional Investor Leverage

Residential rental landlords fully understand and benefit from the power of leverage delivered in real estate investments. Leverage is recognized based on only a fraction of the value of the property is the cash commitment by the investor … with the balance provided by a lender. So, for simplicity assume a property purchased for $100,000 … financed by a down payment of 10% ($10,000) … and a $90,000 mortgage loan.

As the property value increases in asset value, let’s assume 3% annually, the effective return to the investor is based on the amount invested … in this case $10,000. At the end of the first year, let’s say the property is now valued at $103,000 yielding an unrealized gain of $3,000. Now relate that number to the amount ponied up by the landlord and you end up with a paper profit of 30% … $3,000 divided by $10,000! Why? Leverage!

Leverage on Steroids!

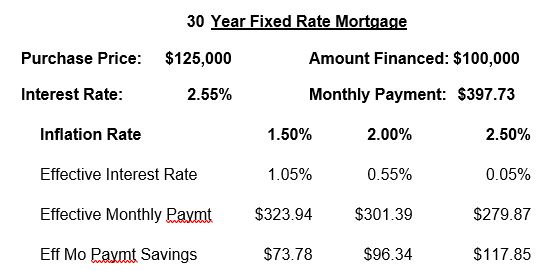

Today, interest rates are at an all-time low. Thirty-year fixed rate mortgage rates hover in the 2% range. So, let’s take a look at the added leverage these historically low rates deliver when inflation is factored in.

Stay with me now while we look at the following:

- Borrowing at interest rates less than inflation = leverage

- Borrower’s interest rate minus the rate of inflation = real interest rate

- Asset value of the property will increase generally in synch with inflation

- Landlords enjoy inflation-stimulated rental spread increases while loan servicing remains level.

Inflation is bad for those with cash on hand as the cost of goods and services in the economy tend to increase in lock-step with the rate of inflation. That said, inflation can be a good thing for residential real estate investors who can borrow money at an incredibly low fixed rate and pay it back later with inflated dollars. In effect, cash today is worth more than cash in the future and favors borrowers in paying lenders back with money that is worth less than it was when the loan was originally granted.

So, since inflation reduces the true cost of borrowing, the “real” interest rate is the nominal rate charged by the lender minus the inflation rate. For example, a loan with a 5 percent nominal rate when offset by an inflation rate of 3 percent means the borrower’s out-of-pocket interest cost is 2 percent.

See these numbers as dramatic illustrations of the incredible opportunity that exists today to refinance or make your first purchase of a rental property … particularly single-family homes. Will this “perfect storm” of ground-floor interest rates positively influenced by inflation repeat itself? Never has, so why hesitate to be a winner.

Perfect Storm to Purchase Single Family Homes for Rent

Yes, I agree that bargains on single family home purchases are few, far-between and in some areas non-existent. That said, in light of the forgoing regarding the synergy of super-low interest and the likelihood of inflation, it doesn’t have to be a perfect world to make attractive long-term, profitable investments.

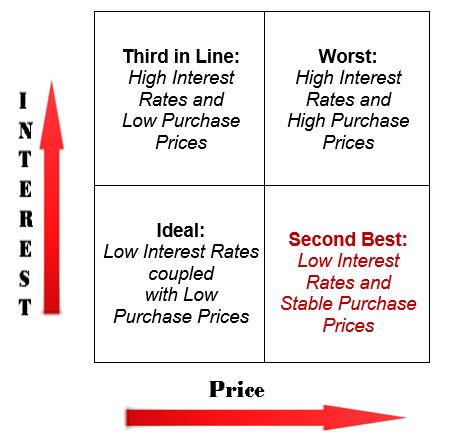

Of course, in order of priority it would be ideal to have:

- Ideal: Low Interest Rates coupled with Low Purchase Prices

- Second Best: Low Interest Rates and Stable Purchase Prices

- Third in Line: High Interest Rates and Low Purchase Prices

- Worst: High Interest Rates and High Purchase Prices

Today, “Ideal” is not an option. However, I believe significant opportunities present themselves in this economic environment of:

Second Best: Low Interest Rates and Stable Purchase Prices

While there may be bargains to be found elsewhere, the sweet spot for investing in residential real estate is affordable, workforce housing … not new construction or high-priced suburbia. Currently, KRS Holdings is enjoying great demand by quality credit risk tenants for single-family-homes and apartments in safe, reasonably priced neighborhoods.

With that profile in mind, this is an excellent time to refinance existing holdings and/or borrow for an addition to your portfolio. Here is my rationale for this belief.

- Fed officials have indicated that they expect to keep interest rates at zero at least through 2023.

- Inflation will increase in a post-COVID world … as will your opportunity to increase rents.

- Short-term, asset appreciation will likely be limited. But equity will be accelerated by paying down the mortgage at today’s low rates.

So, as KRS Holdings seeks to expand its portfolios for our clients and our company, our guiding principles are based on confidence that when it comes to acquiring rental properties today …

With interest rates at record lows, inflation on the horizon …and SFH prices stable

now is a good time to save money and build equity!

Summary

The key to success as a SFH landlord is to remain alert and diligent in serving your tenants and protecting your investment. In this economic climate, don’t miss this, perhaps once-in-a-lifetime, opportunity to buy or refi rental properties … whether an initial purchase or to expand your portfolio.

Note: Whether becoming a landlord was a choice or a result of circumstance, it doesn’t change the fact that managing any property comes with its challenges… and we want to help. At KRS Holdings, we stand by our core principles to always be straightforward and honest

Give us a call or drop an email. We’ll respond promptly to relieve

your stress, help you evaluate your property management options

plus maximize your rental property return on investment.