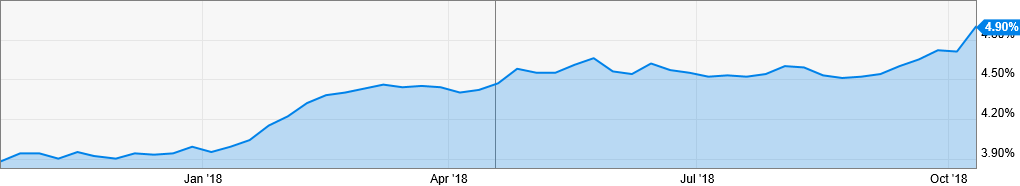

Winners & Losers: Single Family Landlords and/or Renters? It’s no secret … single-family residential mortgages are on the upswing. As a matter of fact, according to YCHARTS the benchmark US 30 Year Mortgage Rate is at 4.90% 3.85% last year. Now put that in perspective. It costs 25% more to borrow money right now compared to the same time last year! So what’s the upshot of this turn of events? We think it’s a diminished market for homebuyers as qualifying for a home loan becomes more onerous. On the flip side of that coin, there may be an enhanced opportunity for residential real estate investors … especially those who have or seek to acquire single-family rentals (SFR). What follows are our reasons for maintaining this point of view. We base the bulk of our assessment in examining the desires and financial status of the two major pools of SFR tenants … Baby Boomers and Millennials. Note: Currently, reports are that roughly one-third of American households rent … and about one-third of those rentals are single-family home … and as we’ll see, it’s very likely that more and more renters will seek an SFR as the housing option of choice..

So what’s the upshot of this turn of events? We think it’s a diminished market for homebuyers as qualifying for a home loan becomes more onerous. On the flip side of that coin, there may be an enhanced opportunity for residential real estate investors … especially those who have or seek to acquire single-family rentals (SFR). What follows are our reasons for maintaining this point of view. We base the bulk of our assessment in examining the desires and financial status of the two major pools of SFR tenants … Baby Boomers and Millennials. Note: Currently, reports are that roughly one-third of American households rent … and about one-third of those rentals are single-family home … and as we’ll see, it’s very likely that more and more renters will seek an SFR as the housing option of choice..

Baby Boomers

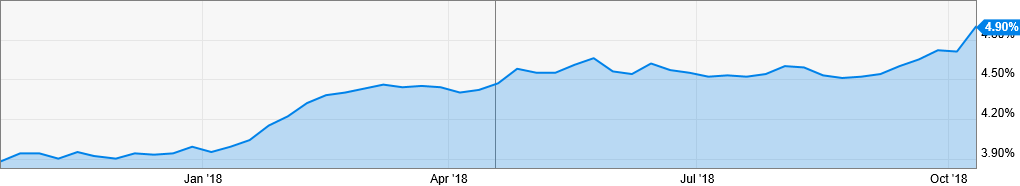

Baby Boomers, the once largest segment of the U.S. workforce, are increasingly in a retirement mode. Often that means downsizing … meaning selling their larger homes, but not abandoning their desire for single-family living. Driven by the desire to be less tied down to the responsibilities of maintaining a home, Baby Boomers are attracted to the comforts of renting. They are motivated to downsize to SFR as an alternative and simpler lifestyle. What is the potential for SFR investors in Central Virginia? Considerable … based on five key factors embodied by the Richmond and Tidewater areas and much sought after by seniors.  Appeal of college towns: Kiplinger’s Personal Finance magazine named “10 smart places to retire” referring to college towns with great appeal to Boomers. The article highlights that towns with a university presence offer intellectual stimulation, spectator sports, arts performances and displays, good dining and a collegial atmosphere. As quoted in a Richmond Times Dispatch editorial, “The Richmond metro area boasts a thriving academic community – the University of Richmond’s campus rivals the University of Virginia in beauty. The region has a full slate of cultural attractions and attention-grabbing food scene.” Much the same may be laid to claim by the Tidewater area. Walkable attractions: At a recent NMHC conference many landlords reported that Boomers want to rent within walking distance of shops, restaurants and entertainment. They want to take classes, stay active and enjoy cultural venues.

Appeal of college towns: Kiplinger’s Personal Finance magazine named “10 smart places to retire” referring to college towns with great appeal to Boomers. The article highlights that towns with a university presence offer intellectual stimulation, spectator sports, arts performances and displays, good dining and a collegial atmosphere. As quoted in a Richmond Times Dispatch editorial, “The Richmond metro area boasts a thriving academic community – the University of Richmond’s campus rivals the University of Virginia in beauty. The region has a full slate of cultural attractions and attention-grabbing food scene.” Much the same may be laid to claim by the Tidewater area. Walkable attractions: At a recent NMHC conference many landlords reported that Boomers want to rent within walking distance of shops, restaurants and entertainment. They want to take classes, stay active and enjoy cultural venues.  Availability of superior medical facilities: US News released their rankings of the top Virginia hospitals. Not only does Virginia have 4 nationally ranked hospitals, we have another 15 that are regionally ranked for their superior performance. Those in the Richmond/Tidewater areas include: Virginia Commonwealth University, Sentara Norfolk General Hospital, Bon Secours Saint Mary's Hospital, Sentara Leigh Hospital and Johnston-Willis Hospital. Affordable lifestyle: Click here for a report by Sperling’s that rates cost of living on indices based on a U.S. average of 100. Overall, Richmond, Virginia cost of living is 95.40 and Tidewater about 98.6. Within the Richmond/Tidewater areas are smaller communities where the cost of living may be cheaper yet. Climate: Virginia's weather has been described as a "Goldilocks Climate" -- not too hot; not too cold -- and is officially considered a humid, subtropical region. Its moderate four-season climate is particularly attractive to senior renters relocating from the northern part of the country as well as the “half-backers” who move to Virginia after a Florida residency proves unsatisfactory due to heat and congestion.

Availability of superior medical facilities: US News released their rankings of the top Virginia hospitals. Not only does Virginia have 4 nationally ranked hospitals, we have another 15 that are regionally ranked for their superior performance. Those in the Richmond/Tidewater areas include: Virginia Commonwealth University, Sentara Norfolk General Hospital, Bon Secours Saint Mary's Hospital, Sentara Leigh Hospital and Johnston-Willis Hospital. Affordable lifestyle: Click here for a report by Sperling’s that rates cost of living on indices based on a U.S. average of 100. Overall, Richmond, Virginia cost of living is 95.40 and Tidewater about 98.6. Within the Richmond/Tidewater areas are smaller communities where the cost of living may be cheaper yet. Climate: Virginia's weather has been described as a "Goldilocks Climate" -- not too hot; not too cold -- and is officially considered a humid, subtropical region. Its moderate four-season climate is particularly attractive to senior renters relocating from the northern part of the country as well as the “half-backers” who move to Virginia after a Florida residency proves unsatisfactory due to heat and congestion.  The presence of all of these pluses will continue to attract Boomers to our region.

The presence of all of these pluses will continue to attract Boomers to our region.

Millennials

Millennials, the most numerous generation in the country cannot be ignored as a major factor in the mix of potential SFR renters. A survey by the National Association of Home Builders found that most millennials want to live in single-family homes outside of the urban center. And they want three or more bedrooms. As they begin to set up households and raise a family, SFRs will be increasingly in demand. The major reason for the trend toward renting rather than buying is the difficulty many … if not most … millennials have in getting a mortgage. There are three major hurdles that inhibit qualifying for a home loan. The first is described earlier, i.e. the significant percentage increase in mortgage interest rates … 25% in the last year. That makes qualifying for a mortgage that much more difficult, especially when you look at the other two limiting factors. Second, a recent study conducted by TransUnion found that millennials had lower credit scores than their parents did at the same age. Instead of applying for and using credit cards and loans for purchases, millennials tend to pay for things directly by writing a check or with their debit cards. That means no established credit history or evidence that they can manage debt. Clearly, the purchase of a home, except for very rare instances, requires a loan … and lenders are unlikely to advance credit without some record of satisfactory debt service in the past. Third, is the debt millennials have incurred to finance their college educations. According to the most recent available statistics, the average college graduate in the class of 2016 had $37,172 worth of student loan debt. Monthly student loan payments are included in determining a loan applicant’s debt-to-income ratio which will affect qualification for a mortgage.  Often burdened by increasing loan interest rates, low credit scores and student debt, many Millennials are not in a position to buy a home, but will welcome the privacy of an SFR.

Often burdened by increasing loan interest rates, low credit scores and student debt, many Millennials are not in a position to buy a home, but will welcome the privacy of an SFR.

For Residential SFR Investors … the Opportunity

It’s been evident for months, the economy’s picking up steam … and so are interest rates. But investors should accept that in the broader context of the investment opportunities that will likely continue to surface in lockstep with economic growth. In the city of Richmond and the surrounding counties of Henrico, Chesterfield, Powhatan, Hanover and Goochland, according to data from the University of Virginia’s Cooper Center, the population of those localities grew by 48,521 people in the last five years. The U.S. Bureau of Labor Statistics reports employment has grown by 42,334 people over the same period. The entire region now employees nearly 700,000 nonfarm workers. The good news is that with this accelerated economic growth together with the desires and financial status of the two major pools of SFR tenants … Baby Boomers and Millennials … SFR investors should be in a position to charge more rent.

Summary

In general, the best investment property for beginners is a residential, single-family dwelling. Single-family homes tend to attract longer-term renters and typically superior tenants that make rental payments on time and take better care of the property. Likewise, these same plusses are drivers for seasoned residential rental investors as well. Additionally, turnover is typically lower than with apartments, landlords don’t have common-area maintenance costs and the asset’s value has meaningful upside compared to apartments. Couple the above with an active and growing pool of Boomer and Millennial renters who find an SFR to be the preferred rental choice and Central Virginia to be a sought-after residential area.