U.S. LABOR PARTICIPATION RATE HISTORY & TRENDS

Projected Growth Generates Enhanced Tenant Pool

Renters Enjoy Accelerated Earnings

Residential Investors Realize Bumps in Rent Revenue

In this article, I share my perceptions of the employment and wage landscape … always with an eye to the likely effects on residential rental landlords, investors and tenants.

Wage Inflation Recap

My position on this subject remains unchanged … Increased Wages Don’t Drive Inflation.

Wage inflation occurs when employers agree to increased compensation demands to attract and retain quality workers as part of the equation to boost profitability. Why else would an employer pay more?

To say rising prices cause inflation is akin to saying snow drifts cause blizzards. Yet the Fed economists and advisors cling to the notion that higher inflation is linked to lower unemployment and vice versa … despite clear historical evidence that theory is neither sound nor valid.

In fact, inflation has eaten into wage gains … not the other way around. In many cases worker raises have been slashed, if not wiped out altogether, by price increases.

Remarkably, there is at least one Fed economist who sees eye to eye with me about wage inflation. Adam Hale Shapiro is quoted saying, “Labor-cost growth has no meaningful effect on goods or housing services inflation.”

Good economic times occur in concert with greater earnings.

Economic Growth Drives Higher Prices … Not Wage Increases.

For more background information, visit the Top Recent Articles section of this newsletter.

Labor Participation … 3 Key Data Points

There’s sizeable upside potential for job growth in the Commonwealth.

Labor participation will grow as the economy continues to expand.

Wages will continue to rise as employers compete for quality workers.

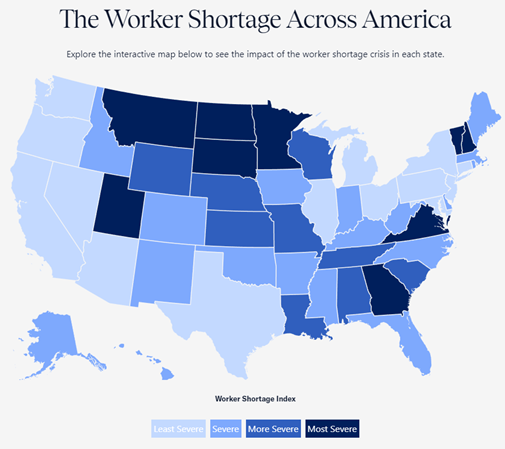

The Virginia Worker Shortage Index reports in July there are 55 available workers for every 100 open jobs. That is in stark contrast to a low of 47 in January. That means significant numbers of workers are entering the labor market … to the tune of a 17% bounce in 6 months!

Click here to visit the U.S. Chamber of Commerce interactive state map.

Reports on job growth are groundless. The Bureau of Labor Statistics reports that 72% of claimed job

increases weren’t created … they were simply jobs lost during the C-19 lockdowns being reclaimed.

The BLS clarified that conclusion with the following. In February 2020, before the lockdowns, jobs peaked at a new height of 152.4 million. By April 2020, that number had plunged to 130.4 million. This month the recovered total is 135.86 million. So, there is plenty of room for a dramatic uptick in employment.

One further point to provide perspective … from the job peak in February 2020 through June 2023, the working-age population grew by 7.2 million, or almost twice the number of new jobs. That means a growing pool of new workers.

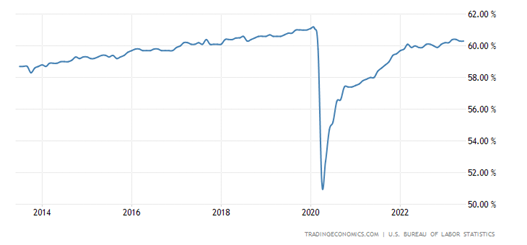

The U.S. employment rate is measured by the number of people who have a job as a percentage of the working age population. According to Statista, in June of this year there were 135.86 million full-time employees in the U.S. That’s a 62.6% labor participation rate, marginally north of the 60.1% reading in February 2020.

Interestingly, the highest employment rate from 1948-2023 is 67.3% according to Trading Economics.

Prophecies of recession are all but abandoned. As the economy grows, think of the net effect of an escalation over the current participation rate to that of the highest … or something in between. Consider these numbers:

A 62.6% labor participation rate means there are 217.029 million potential full-time workers in the U.S.

Each 1% increase in the participation rate adds another 2.17 million workers.

That means a 5% increase from the current 62.6% to mirror the historical high of 67.3% results in an expanded labor force of 10.85 million full-time workers!

I see that as an opportunity for residential rental investors.

As workers return to work, household formation will increase.

More workers drives an expanded pool of renters.

Wage inflation is in lockstep with higher employment as employers continue to bid for quality workers. Hiring managers are sweetening offers with signing-on bonuses and compensation boosted to and often exceeding pre-pandemic norms.

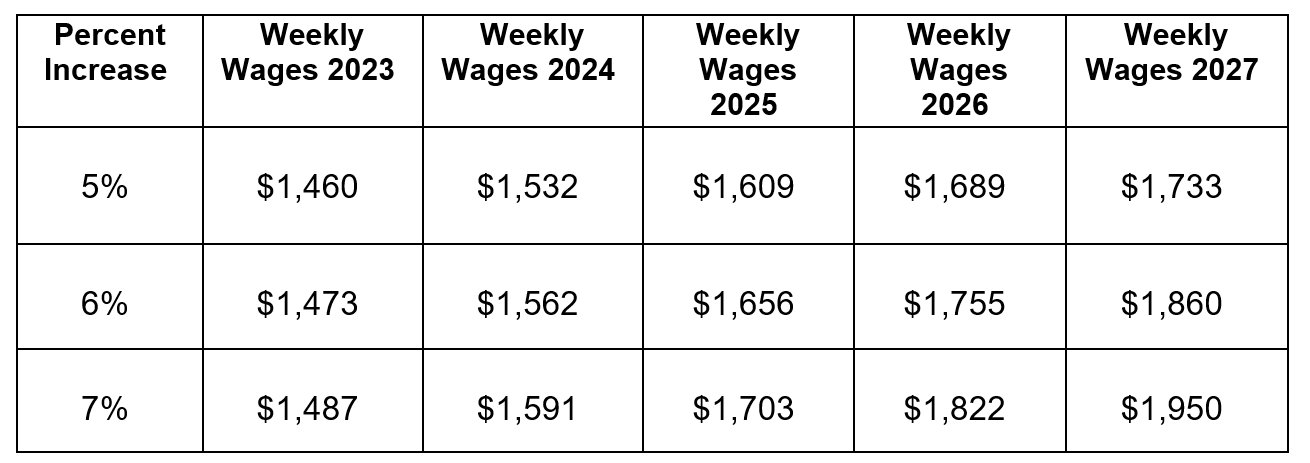

Consider this. The Bureau of Labor reports the end-of-year 2022 increase in weekly wages at 8.9%. If wage inflation and employment growth continue, even at conservative annual growth rates, weekly paychecks may look like the following over the next 5 years.

Takeaways

Admittedly, there are “wild card” factors that may affect the economy in upcoming months … the 2024 elections; Fed moves; geopolitical developments, AI to name major items. That said, I’m of the opinion that wage inflation, job growth and increased spending power will continue this year and into the next.

That means residential rental investors like you and me are likely to experience an expanded tenant pool of workers enjoying sizable bumps in income. Results: Enhancements in rental income, tenant quality and appreciation in asset values.

Whether you are a DIY landlord or someone that needs property management services … or a combo of the two, KRS Holdings is here to help!

Give us a call or drop an email. We’ll respond promptly and

relieve your stress by evaluating your property management options.